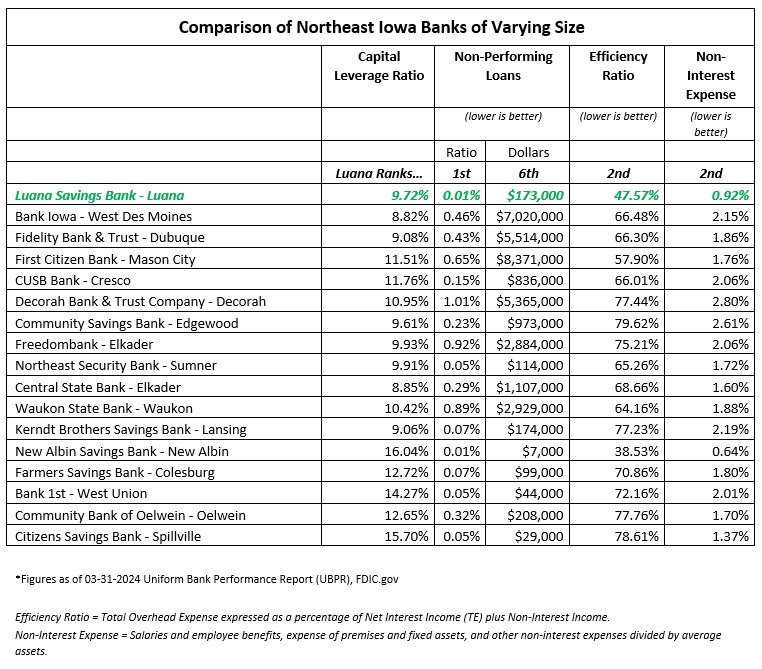

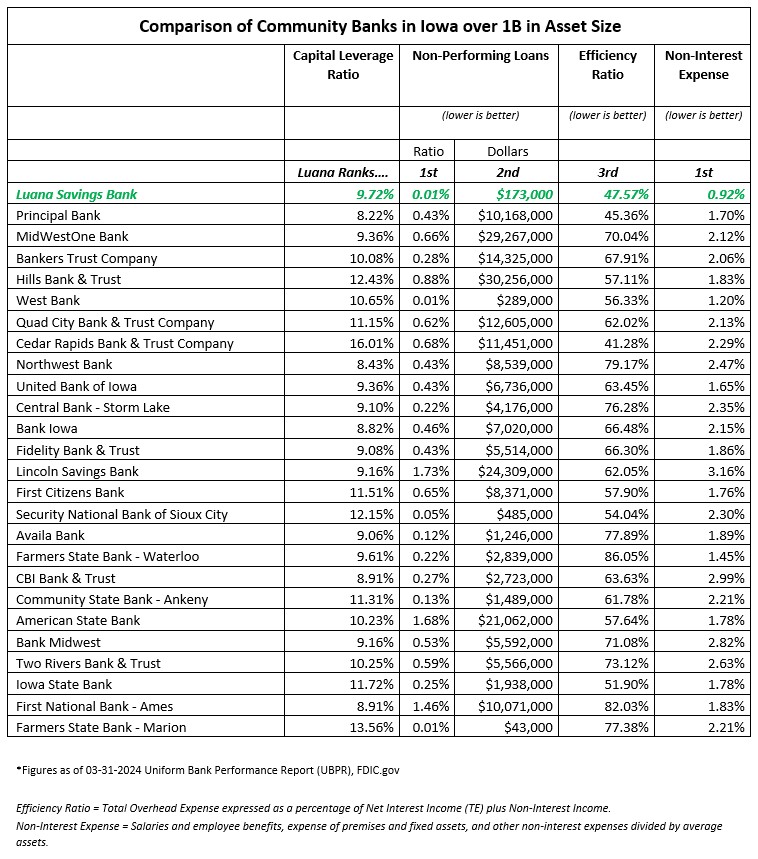

Top Performance Continues for Luana Savings Bank Among NE Iowa Banks & Iowa Banks > 1B in Assets

Performance Update as of 3/31/24

Luana Savings Bank started the first quarter of the year on another high note with great performance, continuing to lead the competition in having an extremely low level of non-performing loans, great earnings, and superior efficiency. Luana achieved solid ROA and ROE ratios which continue to solidify the bank as a top ten financial institution in Iowa.

Why does this matter to customers? Luana Savings Bank’s performance proudly projects financial strength throughout the communities it serves. Luana has zero stresses to capital which is the foundation to a bank’s financial stability and success. This financial strength can be evidenced by its exceptional rankings regarding non-performing loans, efficiency ratio, and non-interest expense.

This superior performance has been maintained for decades at Luana Savings Bank. These results do not happen by accident. Rather, this performance is the result of a top-notch loan team with great underwriting abilities and a motivated deposit team, both of which consistently produce superior results. It is a priority of Luana Savings Bank to maintain this great performance and, in turn, Luana’s customers will be rewarded with great loan and deposit rates, along with exceptional service for years to come.

What ROE, ROA, and Efficiency Ratios Mean for Banks

ROE and ROA are two key measurements showing the success of a bank’s operations. A strong ROE shows how effectively a bank is taking advantage of its base of equity or capital. ROE also shows how efficiently a bank is operated which is a huge contributor to the success of this ratio. A high ROA shows how effectively a bank is creating earnings on its base of assets and managing the overall size of the institution.

Efficiency ratios indicate how effectively a bank is controlling its operating expenses, including how efficiently a bank’s branches operate. For example, Luana Savings Bank has 6 locations, compared to a competitor with over 30 locations. If the same amount of business is conducted within both banks, but one has exponentially higher operating costs due to the number of locations, it is clear how Luana Savings Bank is superior with operating efficiencies.

What ROE, ROA, and Efficiency Ratios Mean for Customers

Luana Savings Bank continues to put quality and profitable assets on its books and therefore the bank’s stellar ROE, ROA, and Efficiency Ratios will continue to shine compared to its peer group. This allows Luana Savings Bank to continue to pay superior money market and certificate of deposit rates to customers while aggressively competing for quality assets.

When customers ask how Luana Savings Bank can pay so much more on deposits than its competitors, great performance in ROE, ROA, and Efficiency Ratios can quickly be accredited as a key to this success. Luana Savings Bank is an excellent steward of its customers’ deposits. Customers are rewarded with great rates of return while having confidence in the performance, safety, and soundness of Luana Savings Bank. Consumer confidence is clearly evidenced with the increase in core deposits by 460 million dollars just over the past 2 years. Over the past 30 years, Luana Savings Bank has kept ROE, ROA, and Efficiency Ratio performance at the very top of the banking industry, which is a clear indicator of a very well-managed institution with low risk.

ROE, ROA, and Efficiency Ratio Defined

Return on Equity (ROE): Annualized bank net income as a percent of average total equity on a consolidated basis.

Pre-Tax Return on Assets (ROA): Annualized pre-tax income as a percent of average total assets.

Efficiency Ratio: Total Overhead Expense expressed as a percentage of Net Interest Income (TE) plus Non-Interest Income.

*Figures as of 3-31-24, Details & Financials, Institution Directory, Uniform Bank Performance Report (UBPR), FDIC.gov

Related...

Competitive Edge at Luana Savings Bank

See "Performance Update as of 3/31/24"

With the rapid rise in interest rates, especially Certificate of Deposit rates, there has been financial stress put on several banks in Iowa and across the nation, a ripple effect from a stressed economy, government, and high inflation. However, Luana Savings Bank has avoided this financial stress for many reasons, apparent in its most recent performance update based on measurable metrics and UBPR reports (see Luana’s 3/31/24 Performance Update). Banking efficiency is undoubtedly a major factor setting Luana apart and above the rest of the banking community in Iowa. While many banks have had to reduce expenses or layoff staff, Luana Savings Bank is proud to have a motivated staff who are cross-trained, creating a very productive 8-hour day and efficiencies hard to duplicate by the banking community. This also creates a huge profit advantage to Luana Saving Bank, allowing the bank to pass savings to customers through some of the highest certificate of deposit and money market account rates in Iowa and across the nation, as well as lower, more competitive loan rates and fees in all types of lending. Luana continues to have strong performance with earnings, liquidity, excess capital, and will continue to serve our deposit and loan customers with top financial products for years to come.

Related...

How Do I Choose? Laddering and Short-Term vs. Long-Term CD Durations

Depositors are finally reaping the rewards of decent returns on Certificates of Deposit (CDs) and Money Market Accounts (MMAs) after a decade of near zero returns. There are many CD specials in the market place today, many of which are shorter in maturity (or “duration”, a term used by the banking industry). Continue reading to learn about “laddering” a popular strategy in today’s market.

So, how does a depositor decide what duration or how long to lock in their CD? Some depositors consider historical yields and any national or world events that may have raised or lowered CD yields fairly quickly and in one case very dramatically. Two such events come to mind where rates tumbled substantially and CD rates suffered; 1) the 9/11 terrorist attacks on our nation, and 2) the real estate crisis in 2007 to 2011. In both events a dramatic drop in CD rates occurred for a period of a decade. With our recent dramatic rise in CD rates, will there be another event that could dramatically lower CD rates again? Luana Savings Bank, or any financial expert or depositor, cannot predict future events. However, we do consider the possibility for them and recommend our depositors do the same.

A middle of the road approach is popular among depositors deciding how long a maturity to choose. Most depositors have heard the term “laddering”, a savings strategy by which a depositor would invest in several CDs with staggered or mixed maturities (i.e. one-year, two-year, three-year, and so on) to take advantage of higher rates on longer terms while preserving access to funds on a scheduled basis, (Time.com). Deposit rates over 5.00% for 24, 30, and 36-month maturities offer great options to put at least a portion of one’s CD holdings into longer-term maturities to reap longer benefits in case there is an event that would cause CD rates to tumble more significantly than normal.

Luana Savings Bank has fantastic performance and top CD offerings recognized across the country in both short-term and longer-term maturities to help depositors with this type of deposit strategy, alongside an exceptional team to provide customers great service with these products.

Laddering definition: https://time.com/personal-finance/article/what-is-a-cd-ladder/

Disclaimer: The content of this article is for informational purposes only, and is not a substitute for professional financial advice. Luana Savings Bank is not a financial advisor, nor offers financial advisement services, and is not liable for personal use of the content within.