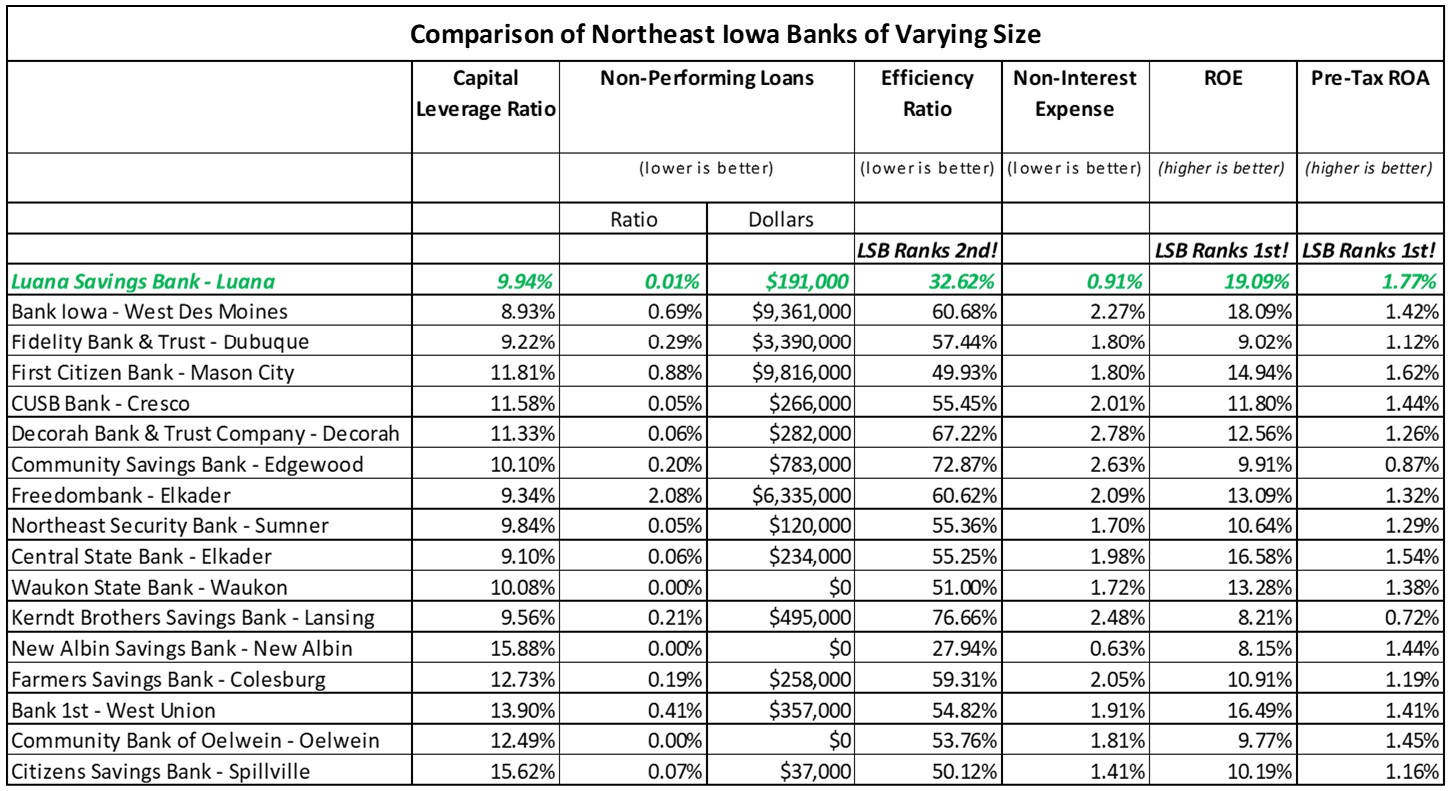

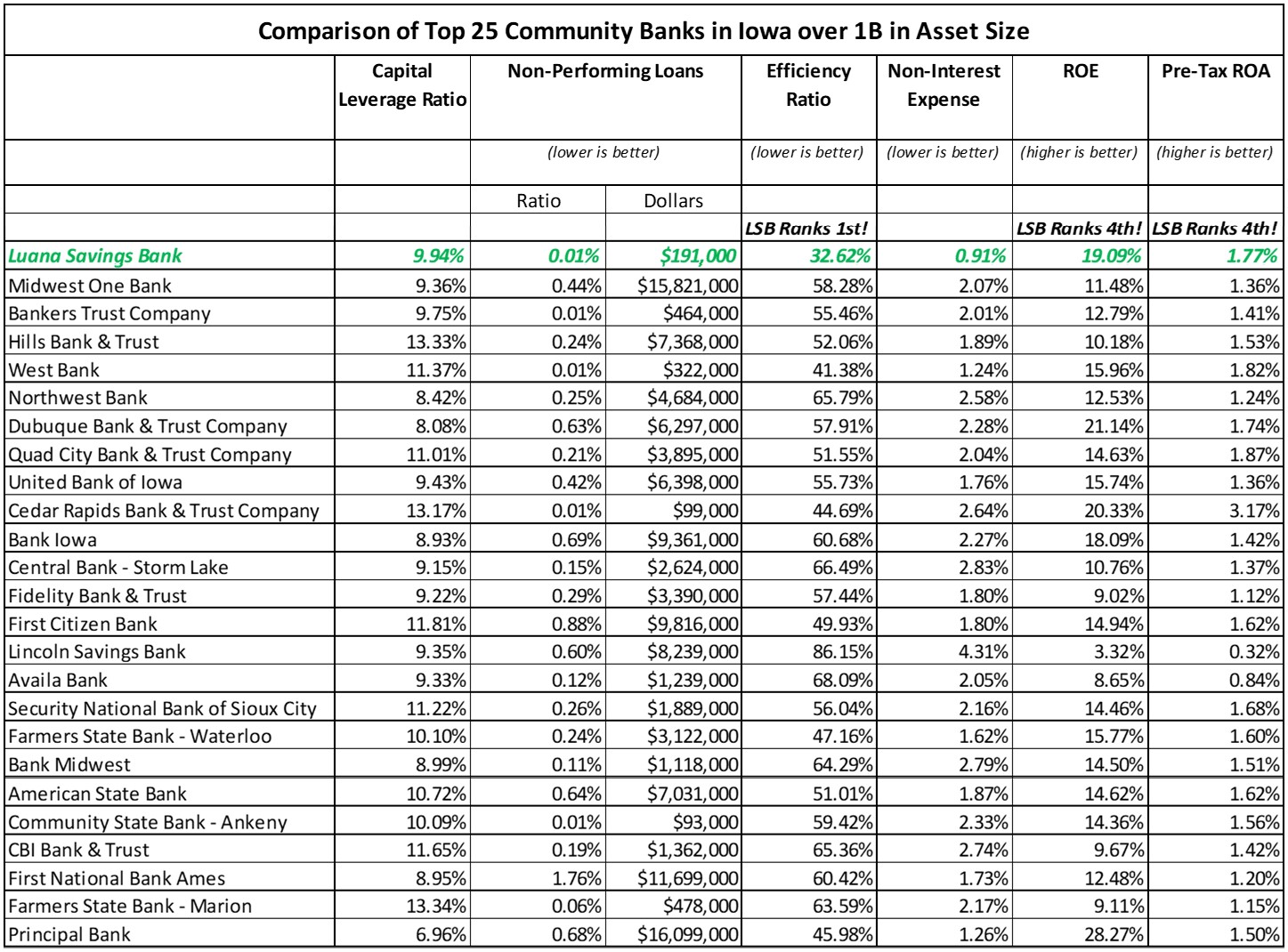

Performance Update as of 12/31/22.

Luana Savings Bank continues to perform at the highest levels of the banking industry in Iowa and across the nation. Luana Saving Bank ranks #1 in both ROE and ROA among Northeast Iowa banks and #4 in both ROE and ROA among Iowa banks over 1 billion in asset size. Luana Savings Bank also ranks #1 in Efficiency among Iowa banks over 1 billion in asset size and #2 among Northeast Iowa banks.

What ROE, ROA, and Efficiency Ratios Mean for Banks

ROE and ROA are two key measurements showing the success of a bank’s operations. A high ROE shows how effectively a bank is taking advantage of its base of equity or capital. ROE also shows how efficiently a bank is operated which is a huge contributor to the success of this ratio. A high ROA shows how effectively a bank is creating earnings on its base of assets and managing the overall size of the institution.

Efficiency ratios indicate how effectively a bank is controlling its operating expenses, including how efficiently a bank’s branches operate. For example, Luana Savings Bank has 6 locations, compared to a competitor with over 30 locations. If the same amount of business is conducted within both banks, but one has exponentially higher operating costs due to the number of locations, it is clear how Luana Savings Bank is superior with operating efficiencies.

What ROE, ROA, and Efficiency Ratios Mean for Customers

Luana Savings Bank continues to put quality and profitable assets on its books and therefore the bank’s stellar ROE, ROA, and Efficiency Ratios will continue to shine compared to its peer group. This allows Luana Savings Bank to continue to pay superior money market and certificate of deposit rates to customers while aggressively competing for quality assets.

When customers ask how Luana Savings Bank can pay so much more on deposits than its competitors, top performance in ROE, ROA, and Efficiency Ratios can quickly be accredited as a key to this success. Luana Savings Bank is an excellent steward of its customers’ deposits. Customers are rewarded with great rates of return while having confidence in the performance, safety, and soundness of Luana Savings Bank. Over the past 30 years, Luana Savings Bank has kept ROE, ROA, and Efficiency Ratio performance at the very top of the banking industry, which is a clear indicator of a very well-managed institution with low risk.

ROE, ROA, and Efficiency Ratio Defined

Return on Equity (ROE): Annualized bank net income as a percent of average total equity on a consolidated basis.

Pre-Tax Return on Assets (ROA): Annualized pre-tax income as a percent of average total assets.

Efficiency Ratio: Total Overhead Expense expressed as a percentage of Net Interest Income (TE) plus Non-Interest Income.

*Figures as of 12-31-2022, Details & Financials, Institution Directory, Uniform Bank Performance Report (UBPR), FDIC.gov